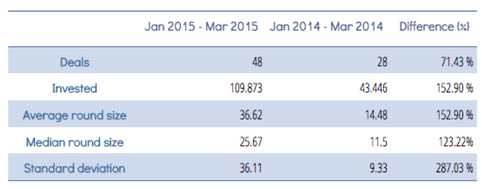

Investments in Spanish startups from Venture Capital firms and business angels increased by +152% (YoY) in the first quarter of 2015, according to a report released by research firm Venture Watch.

In total, Spanish startups raised €109 million across 48 deals. The €109 million mark represents 44% of all euros invested in Spanish tech companies in 2013.

If the pace continues, 2015 could become a record year for the Spanish startup ecosystem in terms of fundraising.

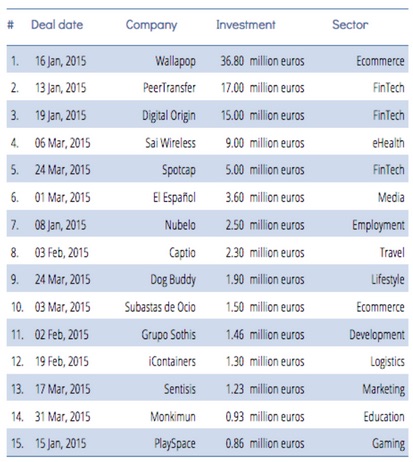

Wallapop’s $40 million Series B round led by Insight Venture Partners accounted for one third of all activity in Spain, with investments in peerTransfer (€17m) and Digital Origin (€15m) also surpassing the €10 million barrier.

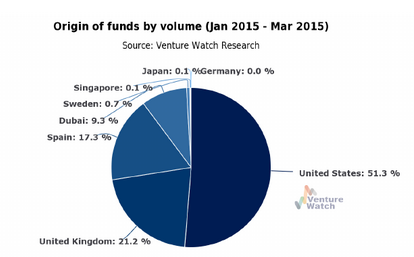

For a long time it’s been said that raising relatively big rounds of funding in Spain is not easy due to the lack of growth capital in the country. But as the following graph shows -and this is true in most European ecosystems-, US Venture Capital firms are the ones who tend to add fuel to the fire at these later stages.

More than half of all euros invested in the first quarter of 2015 came from overseas.

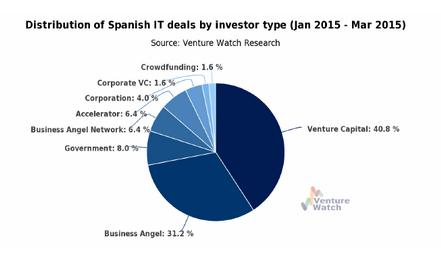

It’s also worth noting that activity from business angels picked up in the first quarter of 2015, being responsible for 31.2% of all deals (not euros), which could point to an increase in activity at the seed and early stage. As Venture Watch points out in its report, the importance of equity crowdfunding platforms is also increasing, as they accounted for 1.6% of all deals (vs. 1.4% for the whole 2014 year).

Thanks to Wallapop’s big round, ecommerce was once again the industry sector that attracted most investment euros. Interestingly, fintech (peerTransfer, Digital Origin, Spotcap) came in second.

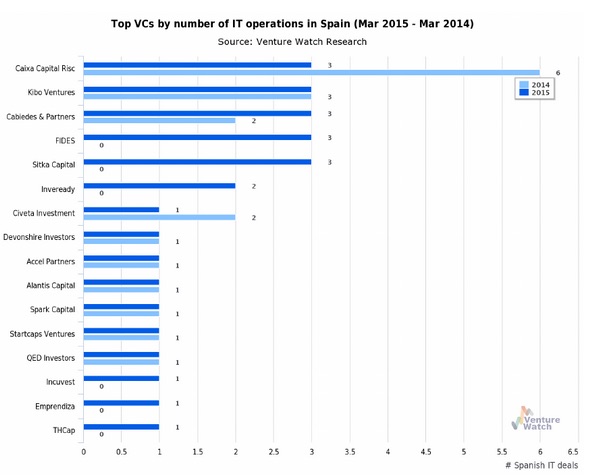

As for the most active Spanish venture capital firms in the first quarter, five were tied at the top with three deals each: Caixa Capital Risc, Kibo Ventures, Cabiedes & Partners, FJME and Sitka Capital.

Despite this significant growth, Venture Capital investments in Spain continue to be significantly lower than in France, Germany, UK or Israel.

Photo | BarcelonaDigital